Tax for hybrid cars in India is 28% and on electric vehicle levies 5%.

In the coming GST council the Finance Minister of India Nirmala Sitharaman, may not discuss the concession on the tax for hybrid cars. Whereas, Mr. Nithin Gadkari Minister of Road Transport and Highways of India requested to reduce the GST hybrid vehicle, which will be favorable for Indian vehicle manufacturers such as Tata Motors and Mahindra & Mahindra .

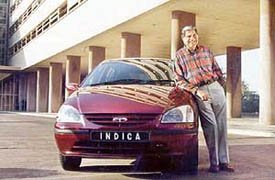

Reduction in tax on hybrid cars will be a positive sign for giants like Tata Motors and Mahindra & Mahindra but on the other hand, the Finance Ministry is against reducing the tax on the hybrid cars.

Nitin Gadkari requested to reduce the tax to 12%. The reduction in the tax will promote eco-friendly transportation and reduce pollution levels in India. Currently, 28% of tax has been levied on the ICE as well as hybrid cars including the cess. The tax rate for certain hybrid vehicles goes up 40%.

This move by the Finance Ministry aligns with the government’s larger strategy to promote green mobility in the country. The government has been introducing various initiatives and policies to encourage the adoption of electric vehicles, including incentives for buyers and manufacturers.

Industry experts have welcomed the decision, noting that it will provide a much-needed boost to the electric vehicle sector. They believe that stable policies and incentives are essential for the growth of the sector and for India to achieve its goal of becoming a leader in electric mobility.

Looking ahead, the decision to maintain the tax rate on hybrid cars is expected to drive further growth in the electric vehicle sector. With the government’s continued focus on green mobility, the future looks promising for the electric vehicle industry in India.

Source: ET Auto

Also Read:

Tata Motors Shares fells Over 9% Following Q4 Results: Brokerages Offer Mixed Outlook

Tata Motors beats Maruti’s best-sellers in April’24: Punched Maruti and Hyundai